Home

Issues

Aims and Scope

Open Access

Editorial Board

Indexing

Why publish with us

Contact us

Instructions to authors (PDF)

Manuscript Types

Manuscript Formatting

How to submit

Preprints

Special Publications & Reprints

Authorship & COI

Principles of Transparency Checklist

Data Policies

Publication Ethics and Publication Malpractice Statement

An evaluation of the cigarette tax increase impact on illicit trade in 5 Colombian cities

1

Fundación Anaás, Colombia

2

Universidad del Rosario, Colombia

3

Fundación Anáas, Colombia

Publication date: 2018-03-01

Tob. Induc. Dis. 2018;16(Suppl 1):A116

KEYWORDS

TOPICS

ABSTRACT

Background:

Few studies in middle income countries assess the effect of a sharp tax increase on observed consumption of illicit cigarettes. The 2016 tax reform in Colombia resulted in a 100% increase of the excise tariff for 2017. This study evaluates the changes in penetration of smuggled products associated with the tax increase nine months after it became effective. The policy of interest is the excise tax increase effective in January 2017 (from 23 to 48 cents per 20 cigarette pack), the first jump in a two-year adjustment period.

Methods:

Non-participant group is defined as smokers in 2016, since the tax measure affects all smokers. Evaluation will use the results of a smoker survey in five Colombian cities in 2016 and a second one planned for September 2017, specifically designed to measure penetration of illicit trade. A matching technique is used considering three dimensions: spatial, age and gender. This provides an adequate comparison. By comparing individuals in the same zone in each city of the same gender and the same age it can be established to what extent the price increases (attributable to new tax levels) are associated with consumption patterns.

Results:

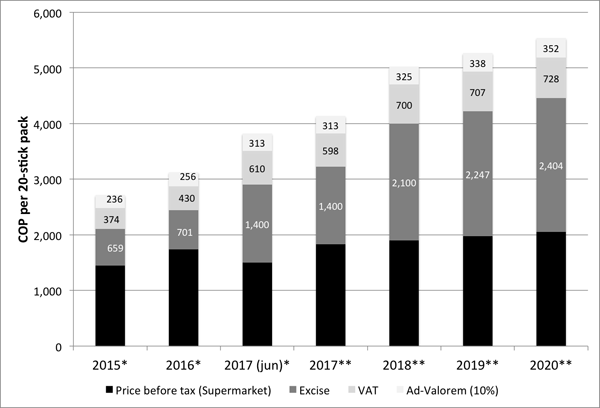

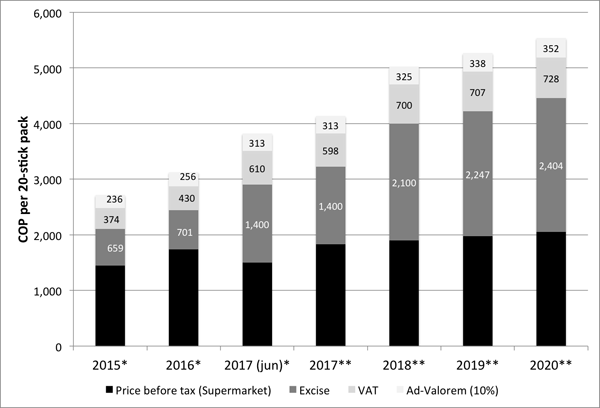

The 2016 survey estimated a 3,5% penetration of illicit cigarettes, with significant differences across cities. Price behaviour indicates that tax has not been fully transfered to consumers yet, with a 22% annual hike (first semester average) but it is getting closer to the expected result.

[Changes in price structure after tax reform]

Conclusions:

First wave results suggest that tax levels are not the only driver of illicit trade, since cigarette taxes are the same for all the country. Cities closer to the border and with weaker institutional conditions are more prone to have consumers of smuggled cigarettes. This points at the need to dedicate efforts to target tax administration efficiency to protect revenues in those areas.

Few studies in middle income countries assess the effect of a sharp tax increase on observed consumption of illicit cigarettes. The 2016 tax reform in Colombia resulted in a 100% increase of the excise tariff for 2017. This study evaluates the changes in penetration of smuggled products associated with the tax increase nine months after it became effective. The policy of interest is the excise tax increase effective in January 2017 (from 23 to 48 cents per 20 cigarette pack), the first jump in a two-year adjustment period.

Methods:

Non-participant group is defined as smokers in 2016, since the tax measure affects all smokers. Evaluation will use the results of a smoker survey in five Colombian cities in 2016 and a second one planned for September 2017, specifically designed to measure penetration of illicit trade. A matching technique is used considering three dimensions: spatial, age and gender. This provides an adequate comparison. By comparing individuals in the same zone in each city of the same gender and the same age it can be established to what extent the price increases (attributable to new tax levels) are associated with consumption patterns.

Results:

The 2016 survey estimated a 3,5% penetration of illicit cigarettes, with significant differences across cities. Price behaviour indicates that tax has not been fully transfered to consumers yet, with a 22% annual hike (first semester average) but it is getting closer to the expected result.

[Changes in price structure after tax reform]

Conclusions:

First wave results suggest that tax levels are not the only driver of illicit trade, since cigarette taxes are the same for all the country. Cities closer to the border and with weaker institutional conditions are more prone to have consumers of smuggled cigarettes. This points at the need to dedicate efforts to target tax administration efficiency to protect revenues in those areas.

Share

RELATED ARTICLE

We process personal data collected when visiting the website. The function of obtaining information about users and their behavior is carried out by voluntarily entered information in forms and saving cookies in end devices. Data, including cookies, are used to provide services, improve the user experience and to analyze the traffic in accordance with the Privacy policy. Data are also collected and processed by Google Analytics tool (more).

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.

You can change cookies settings in your browser. Restricted use of cookies in the browser configuration may affect some functionalities of the website.